Posted on: September 16, 2025, 08:02h.

Last updated on: September 16, 2025, 08:02h.

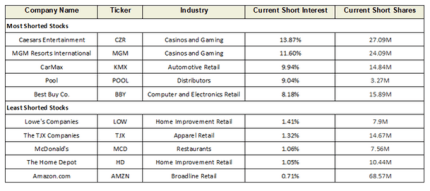

- Caesars, MGM favorite targets of short sellers in August

- Overall bearish bets against casino stocks declined last month

Short sellers sank their teeth into Caesars Entertainment (NASDAQ: CZR) and MGM Resorts International (NYSE: MGM) last month, making the two casino equities the most shorted consumer discretionary stocks.

Both stocks also ranked among the 10 most shorted names in the S&P 500 in August, but that’s a dubious distinction Caesars won’t have to worry about for the foreseeable future. Earlier this month, S&P Dow Jones Indices said the Harrah’s operator is one of three stocks being removed from the benchmark domestic equity gauge. That move occurs prior to the open of US markets on Sept. 22.

As of the end of August, bearish traders had sold short 27.09 million shares of Caesars, or 13.87% of the casino operator’s float. For MGM, 24.09 million shares, or 11.60% of the total float, were on loan to short sellers.

That was enough to make the gaming Goliaths the most short consumer cyclical names last month. No other members of the industry ranked among the top five most shorted consumer discretionary stocks and no gaming equities were among the five least short consumer cyclical stocks as of Aug. 31.

Caesars Often Draws Crowd of Short Sellers

Caesars, which often ranks among the most shorted names in the S&P 500, and other casino stocks have been favorite targets of bearish traders this year for a variety of reasons.

Earlier this year, it was volatile US trade policy culminating in the Liberation Day sell-off that prompted shorts to bet against the likes of Caesars, MGM, and Wynn Resorts (NASDAQ: WYNN). More recently, it’s been mounting evidence of declining Las Vegas Strip visitation and downbeat second-quarter earnings reports confirming as much.

Both Caesars and MGM were drubbed in July, but traders wagering against the casino stocks last month had to deal with rallies — a particularly noticeable one in the case of MGM. However, both gaming equities settled at prices today that were just pennies removed from the Aug. 1 closing prints.

“Bets against the Casinos, Leisure and Luxury Goods sector as a whole, however, have declined at the end of August compared to July-end,” according to Seeking Alpha.

Caesars Shorts Could Soon Be Uncomfortable

Caesars could be in focus tomorrow because the Federal Reserve is widely expected to unveil its first interest rate cut since last November. On Aug. 22, the stock popped when Fed Chair Jerome Powell implied rate cuts were on the way.

The reasoning is simple. Caesars is one of the most debt-laden companies in the industry and it’s estimated that for every 100 basis points rates decline, the Horseshoe operator could save $60 million in yearly interest expenses. It’s a situation Caesars short sellers are forced to monitor because if President Trump is successful in forcing Powell out, the next Fed leader is likely to accelerate rate reductions, potentially providing ballast to Caesars and other casino stocks.

“Three rate cuts are our base case under a new Trump administration-favored Fed chair,” notes Andrzej Skiba, head of BlueBay US fixed income at RBC Global Asset Management. “This might eventually be seen as inflationary (easing into an improving economy), supporting the argument for a steeper Treasury curve, but that’s a debate for the latter part of 2026, not something we expect to drive the markets right now.”

Recent Comments