Snapchat has published its latest performance update, with the app, unsurprisingly, seeing a decline in daily active users, though it still posted a steady rise in revenue for Q4 2025.

And with Snap about to hit a critical stretch for the future of the business, with the launch of its AR Specs, the numbers here are important for the company’s overall foundation moving forward.

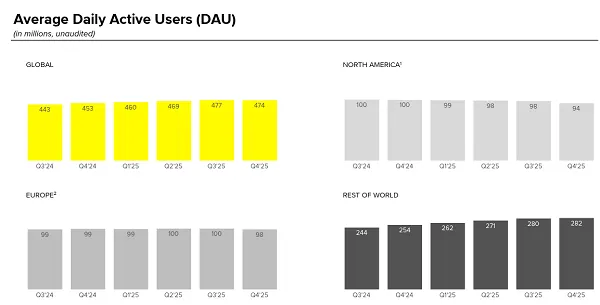

First off, on active users. Snapchat lost 3 million daily active users versus Q3, and is now sitting at 474 million DAU.

Which, as noted, is not overly surprising, considering that Snapchat was banned in Russia in early December, as part of the Russian government’s push to get more people using its own social media app, while Snap also lost a heap more users in Australia just a few weeks after that, due to the Australian government’s new under 16 social media restrictions.

These two actions would cumulatively have seen Snapchat lose an estimated 8.5 million users in a matter of weeks, through no fault of its own. With that in mind, the fact that Snapchat’s daily usage has only declined by 3 million suggests that it’s actually done pretty well to maintain engagement in the app.

Though as you can see in the above charts, Snap is also losing users in the U.S., its key revenue market, and that doesn’t bode well for its future prospects.

Snapchat usage has been steadily declining in both the U.S. and EU over time, which suggests that the app may have reached its saturation point, and that it’ll now have to rely on pumping in more ads to boost its revenue intake.

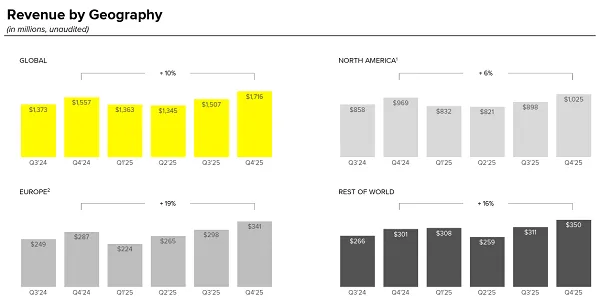

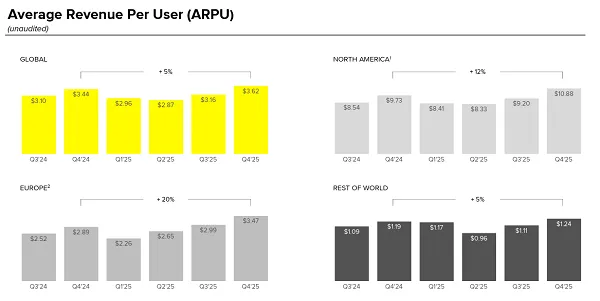

Though at least at this stage, that’s working, with Snapchat bringing in $1.72 billion for the quarter, up 10% year-over-year.

Though again, Snap remains heavily reliant on the U.S. market for its revenue, with its average revenue per user not shifting enough in the “Rest of World” category, year-over-year, to capitalize on its expanded opportunities.

Though Snap is working on this.

In its letter to shareholders, Snap says that it remains focused on diversifying its revenue intake, and driving the business “toward more profitable growth.”

As per Snap:

“For the advertising business, our focus will be on three core initiatives. The first is fostering direct connections between Brands and Snapchatters, by leveraging our core product capabilities across Snapchat. The second will be making it easier and more performant for advertisers to connect with Snapchatters by leveraging AI tooling and capabilities end-to-end through our ad platform, including creative development, campaign setup, and performance optimization. Finally, we plan to grow our advertiser base by scaling and optimizing our go-to-market operations that support the success of small and medium-sized businesses (SMBs).”

SMBs have been a big focus, which has helped to drive the company’s revenue growth, while Snap also notes that its non-advertising projects, including Snapchat+ and additional Memories storage, have helped to boost intake.

“In the year ahead, we will focus on growing existing subscription offers, while innovating to bring compelling new offers to our platform. This momentum is already materializing, with subscribers growing 71% year-over-year to reach 24 million in Q4. In the year ahead, growth in subscribers will be a critical input metric to track our progress, and we will ultimately grade our performance based on growth of the annualized run rate for Other Revenue.”

That’s an important note, that Snap is now trying to focus on maximizing the money it can make from its existing audience, in order to reduce the focus on growth. That’s a riskier bet, as too many ads will be intrusive, while subscription offerings have never ended up being a major revenue driver for any social media app, in comparison to ad spend.

But with growth declining, Snap has little choice but to make this the aim, in the hopes that investors are not put off by those user numbers.

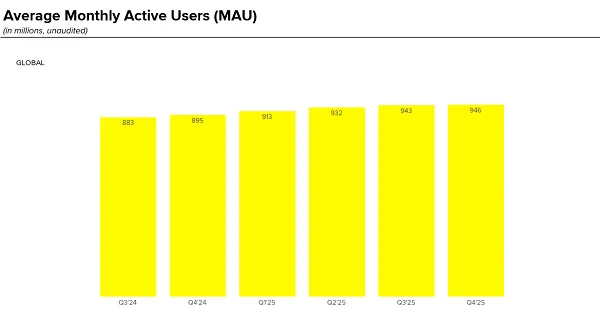

It’s also putting more emphasis on monthly actives, which continue to grow.

So, overall, things are still all good, right? It may have fewer people logging in every day, but it has more coming by to check out the app every month. Which either means that Snap isn’t as essential as it once was, or that people are getting more value out of the app as an entertainment platform, as opposed to a day-to-day messaging utility.

But the real challenge for Snap is coming, with the launch of its AR Specs.

Snapchat has been working towards the release of its fully AR-enabled sunglasses for years, longer than Meta or Apple have been working in the space, while it’s also long been the leader in AR engagement, and creating viral trends from AR activations.

That will give Snap some market advantages, but going up against the infinite resources of Meta, which already has a hold on the smart glasses market, is going to be a tough ask, no matter how Snap approaches it.

And it’s not going to work.

Snap’s cumbersome AR Specs are going to be heavier, less functional, and less valuable than Meta’s coming AR device, which is set for consumer launch next year. So while Snap is going to get ahead of the game, which could give it first-mover advantage, it’s not going to beat Meta on this front.

Snap has wisely split out Specs into its own business unit, in order to shield its main business from losses when its AR glasses inevitably fail. But it needs to tread carefully here, and not over-invest in a device that’s unlikely to win out.

“We believe Snap is uniquely positioned to lead the next wave of spatial computing. With Snap OS 2.0, Lens Studio, Snap Cloud, and a global developer ecosystem, we have built an end-to-end AR platform spanning software, tools, and hardware. Together, these capabilities position us to deliver fully standalone, human-centered eyewear that expands creative expression and unlocks new ways for people to engage with the world around them.”

This is where Snap’s strength lies, in building an AR platform, but its own device is just not going to be able to hold up once Meta’s AR glasses arrive. And Zuckerberg also has a personal vendetta against Snap for rejecting Meta’s takeover offer for the company many years back, so you can bet that Meta’s going to dampen any enthusiasm around Snap’s Specs any way that it can.

That will be a key test for Snap, as a business, and for Evan Siegel as its chief.

Overall, this is the report card I would have expected for Snap at this stage, with various challenges ahead of it, and limited avenues to address them.

Will Snap overdo it with ads, and turn more users away, or will it be able to get the balance right, and capitalize on the users that it has, which will then allay market fears about its shrinking user counts?

Recent Comments