Oh look, Microsoft has published its latest quarterly performance report, I wonder whether LinkedIn saw “record engagement” in the period?

Oh wow, it did. How totally unexpected.

As you can see in this overview taken from Microsoft’s Q3 2025 performance update, LinkedIn once again saw 9% session growth in the measurement period, with “record engagement”.

Which is the same update that Microsoft reports for LinkedIn every quarter.

And that’s not an exaggeration, in literally every single one of Microsoft’s quarterly updates since 2018 (except one), it’s shared a variation of the exact same LinkedIn update: “Sessions growth of x% with record levels of engagement.”

Every quarter. Every time.

Which seems impossible, right? I mean, it can’t be a new record every time. There’s the downtime over Christmas, for example, the end-of-year period, surely LinkedIn’s not seeing “record levels” of engagement in that last three months of the year over the preceding period. Right?

Well, according to parent company Microsoft, it’s all a record, with the only real measurement that we have to go on being sessions growth.

Which has slowed of late.

LinkedIn sessions growth was 11% in the same reporting period in 2024, but its only 8% now.

I mean, if it’s going up, that’s still a good thing, but given the limited stats we have to go on, all we know for sure, based on this overview, is that LinkedIn is making more money (revenue up 7% year-over-year), and that users are coming to the app a little more often.

Though Microsoft did provide some additional LinkedIn performance notes in its earnings call this time around.

According to Microsoft, LinkedIn membership “continues to grow at double digits year-over-year.”

I mean, that too is a bit of a misleading stat, because “members” are not the same as “active users.” And considering that more people are coming into the workforce all the time, you would expect that the amount of people signing up for LinkedIn, and becoming members, would continue to rise.

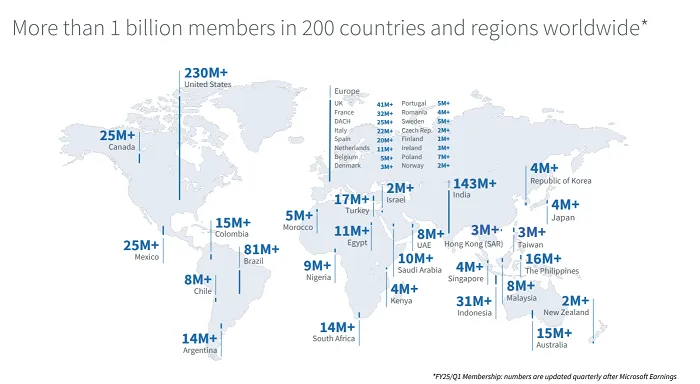

As such, this member map:

Yeah, I don’t really think this means much in terms of understanding the popularity or value of the platform in this respect.

What I can tell you is that, based on LinkedIn’s European usage data, which it has to report as part of the EU DSA regulations, around 28% of the platform’s EU members (as per the above map) are logging into the app each month.

Assuming that holds for other regions, then LinkedIn’s monthly active user count is around 280 million, as opposed to its billion-member headline figure.

I’d assume that the U.S. actually sees more usage, so maybe it’s more like 300 million total MAU. But comparatively, LinkedIn’s active engaged audience is much closer to that of Reddit (189m MAU) than the bigger platforms like Instagram (1b), or even X (600m).

That might provide a better measure of its actual engagement performance, which could help to inform your ad spend. But then again, LinkedIn’s audience is pretty unique, so it might not make a heap of difference either way.

Microsoft has also reported that time spent watching video posts in the app has increased by 36% year-over-year, while comments are up 32%.

So they have actually given us some real engagement data this time around, and the fact that comments are rising so significantly is another valuable point, which could help to inform your approach.

I would assume that video posts are driving a lot of those comments, with LinkedIn also recently reporting that video content generates 1.4x more engagement than other post formats. But carousel posts also attract a lot of engagement, according to third-party analysis.

LinkedIn’s also seeing more of its audience tap into AI to gain new skills and find jobs.

“The number of learners who have used AI-powered coaching increased over 2X quarter-over-quarter.”

As more people become aware of AI tools, more people will use them, and it’ll be interesting to see how beneficial these AI training elements can be over time.

Finally, Microsoft also says that sign-ups for LinkedIn Premium Company Pages increased 75% quarter-over-quarter.

Though that’s also a little misleading, as LinkedIn only made Premium Pages available in all regions last June. Which means that sign-ups will inevitably have increased, based on availability alone, so not sure this is truly indicative.

But this is the way with LinkedIn, and the way it has been since it got acquired by Microsoft back in 2016. As it’s no longer obligated to share in-depth performance data, because it’s not a listed entity within itself, it doesn’t, and we just have to make do with whatever scraps of info it shares with us, and take things like “record engagement,” with no further qualification, as fact.

But all of its data points come with a “yes, but,” all of them are slightly eyebrow-raising upon scrutiny.

But if you wanted to get a handle on LinkedIn’s actual comparative performance, hopefully these explanations add context.

Recent Comments